Digital Deep Dive: Center for Digital Strategies Visits China

February 8th, 2019Topics: AI & Machine Learning Big Data / Analytics Culture Customer Entrepreneurial Tech Global Infrastructure Manufacturing Marketing / Sales Privacy Robotics Value Chain

In our first meeting as second year CDS MBA Fellows this past fall, we crowdsourced a list of “must know” technology companies: Ping An, an insurance-tech giant based in China made that list though half of us had never heard of it. The moment underscored a gap, also known as an opportunity, for us to gain a firmer handle on digital innovation outside the U.S., particularly in China, where some of the most advanced software and technology is now developed. Fortunately, MBA Fellow Yinong Ding, was very familiar with the company from her internship and able to enlighten us to the company’s scale and importance.

The center provided the perfect avenue to help bridge this knowledge gap through an immersive visit to China this past fall. The inaugural trip to China brought a small group of students together with Associate Director Patrick Wheeler to dive deep into Shanghai’s digital scene. We visited a diverse swath of digital companies in various sectors and at various stages, and we are excited to share some of our key takeaways from the trip.

Chinese consumers are ready tech adopters

The sense on the ground as visitors to China is that Chinese consumers are still excited and eager to embrace new technologies. In a country of over 1.4 billion people, nearly 800 million1 had internet access via a mobile device as of the end of 2017, and that figure continues to grow. In fact, mobile payments via WeChat or Alipay are the preferred and sometimes only method of payment accepted by commercial vendors. The payment QR codes were ubiquitous, from restaurant tabs to subway tickets – even street musicians in a main square were looking for QR code transfers rather than cash in their guitar case. And conversely, in the few times that we tried to use a credit card, we either were declined or ended up having to use cash.

Consumers are also benefitting from rapid releases of new products and applications, thanks to the relatively low costs of local prototyping available in China. That said, competition for consumer attention is cutthroat. Any successful idea is swiftly copied. Scale for any venture is easy as a “niche” segment can contain several million customers. In this hyper competitive environment, we heard that companies are now starting to look beyond increasingly penetrated Tier 1 & 2 cities. Tier 3 and Tier 4 cities, while perhaps viewed as less developed, are now becoming viewed as ways to fuel the next stage of growth.

Still early days for Chinese B2B

Yinong Ding T’19 with Yiqing Yang T’17 of Baozun

As high tech as the Chinese consumers are, we discovered that Chinese businesses are more reticent in adopting increasingly sophisticated technologies. We had the opportunity to visit a couple of the flourishing B2B companies: Black Lake Technologies and Baozun.

Black Lake Technologies, a smart manufacturing company founded by Dartmouth Alumnus Yuxiang Zhou, is working to modernize the approximately 400,000 factories in China still using paper to track production lines. The company originally sought to provide data analytics software to these factories but realized most data was not even captured digitally, hence the pivot. Baozun, which is Alibaba’s largest partner, provides the full spectrum of ecommerce services to the world’s leading brands looking to establish their presence in China.

These companies are great examples of digital approaches to B2B problems in China, but they certainly have their work cut out for them. The availability of affordable labor and traditions of Chinese manufacturing mean technological evolution is slow and keeps the Chinese B2B space slightly behind its American counterpart in sophistication.

China is well positioned to win the AI race

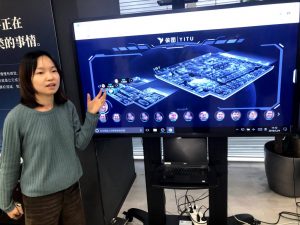

Ran Zheng of YITU demonstrating the company’s AI-based facial recognition system

We visited AI and facial recognition firm YITU and were amazed at what we saw. The combination of massive scale and availability of data due to a lack of restrictions on privacy and the government’s metered dissemination of data to key companies left us feeling like China would likely pass the U.S. in AI sophistication, if it had not already. YITU makes use of its technology across a wide range of applications, including medical imaging (used to detect lung tumors, for example), security (it boasts 1.8 billion faces in its databases and has aided in arresting fugitives on the run for almost two decades), and in the retail environment where it helps with in-store pathing analysis, among other solutions. China has been investing heavily in AI and has both vast data sets and an educated population to outpace other countries in AI.

Smart infrastructure should develop rapidly in China

The incredible magnitude, expected growth, and expanding needs of the Chinese population bring certain inherent challenges.

Alison Dieringer T’19 and Yinong Ding T’19 sit behind the wheel of NIO’s ES8 High-Performance Electric Flagship SUV

We saw first-hand into one of these areas as we visited NIO, an electric vehicle manufacturer also working on developing autonomous driving software. With air pollution continuing to be a major issue in most large urban centers, we saw several other electric vehicle brands currently competing with NIO on the roads as well as many electric buses, demonstrating the urgency and attention the space is receiving. NIO has found ways to stand out, though, including through a steadfast focus on building not just a customer base but also a community. The company offers its clients access to a series of clubhouses, exclusive events, and even childcare.

While improvements to existing infrastructure have their limits, China has the unique opportunity to build new and smarter city infrastructure basically from scratch. To address population needs, China is developing multiple cities, which would be considered large in U.S. city terms, each year. With access to the data from existing megacities and less vocal privacy concerns from citizens, the Chinese government can work with both leading technology and infrastructure providers to develop the most advanced cities seen to-date as well as continue to learn and improve its process going forward. It is hard to imagine a world where China is not a leader in “smart” cities in the coming decades.

This trip was just the beginning

We see this trip as the start of deepening our understanding of China and Chinese innovation in the center. As such, we plan to make a trip of this sort an annual tradition. To truly learn about digital strategies around the globe, it’s important to immerse yourself into that environment and build lasting relationships. That is especially true when talking about China, and we are all thankful to have been part of the inaugural group.

Special Thanks

We would like to thank the following companies and people for sharing their time so graciously with us.

| Organization | Description | People |

| Ant Financial | Financial subsidiary of Alibaba | Shuo Huang, T’14 |

| Baozun | Ecommerce provider and Tier 1 Alibaba partner | Yiqing Yang, T’17 |

| Black Lake Technologies | Provider of digitalization and collaboration tools for factories | Yuxiang Zhou (Dartmouth grad) and Min Ying (Thayer grad) |

| CEIBS | Premier business school of Shanghai | Jeffrey Towson, Professor focused on business in China |

| NIO | Electric vehicle manufacturer and autonomous driving software developer | Louis Liu and Annie Hsu T’11 |

| PAG | Large private equity firm | Yang Zhang, T’12 |

| YITU | Developer of image recognition technology utilizing AI & ML | Joy Xue and Ran Zheng |

Endnotes

- Per the China Internet Network Information Center (CNNIC)